What You Need to Know About: Aseptic Fill & Finish CDMO Market

The global aseptic fill and finish CDMO market demonstrates robust expansion across multiple market assessments. The market is valued at USD 13 billion in 2023 and projected to reach USD 20 billion by 2027, representing an impressive 11% CAGR. Alternative market estimates show the broader aseptic fill finish market growing from USD 6.71 billion in 2025 to USD 17.17 billion by 2034, maintaining a consistent 11.04% CAGR. The pharmaceutical aseptic fill & finish CMO segment specifically is projected to grow from USD 2.80 billion in 2024 to USD 7.39 billion by 2033 at a CAGR of 11.4%.

This exceptional growth significantly outpaces the broader pharmaceutical sector, driven by several key factors: the 65% biologics composition of current development pipelines1, strategic outsourcing trends as companies pursue R&D-focused capital allocation, and the injectable segment representing over 70% of products under development.

Competitive Landscape and Market Share Analysis

This exceptional growth significantly outpaces the broader pharmaceutical sector, driven by several transformative factors. The 65% biologics composition of current development pipelines1 has created unprecedented demand for specialized aseptic processing capabilities. Strategic outsourcing trends are accelerating as pharmaceutical companies pursue R&D-focused capital allocation, with the injectable segment representing over 70% of products under development.

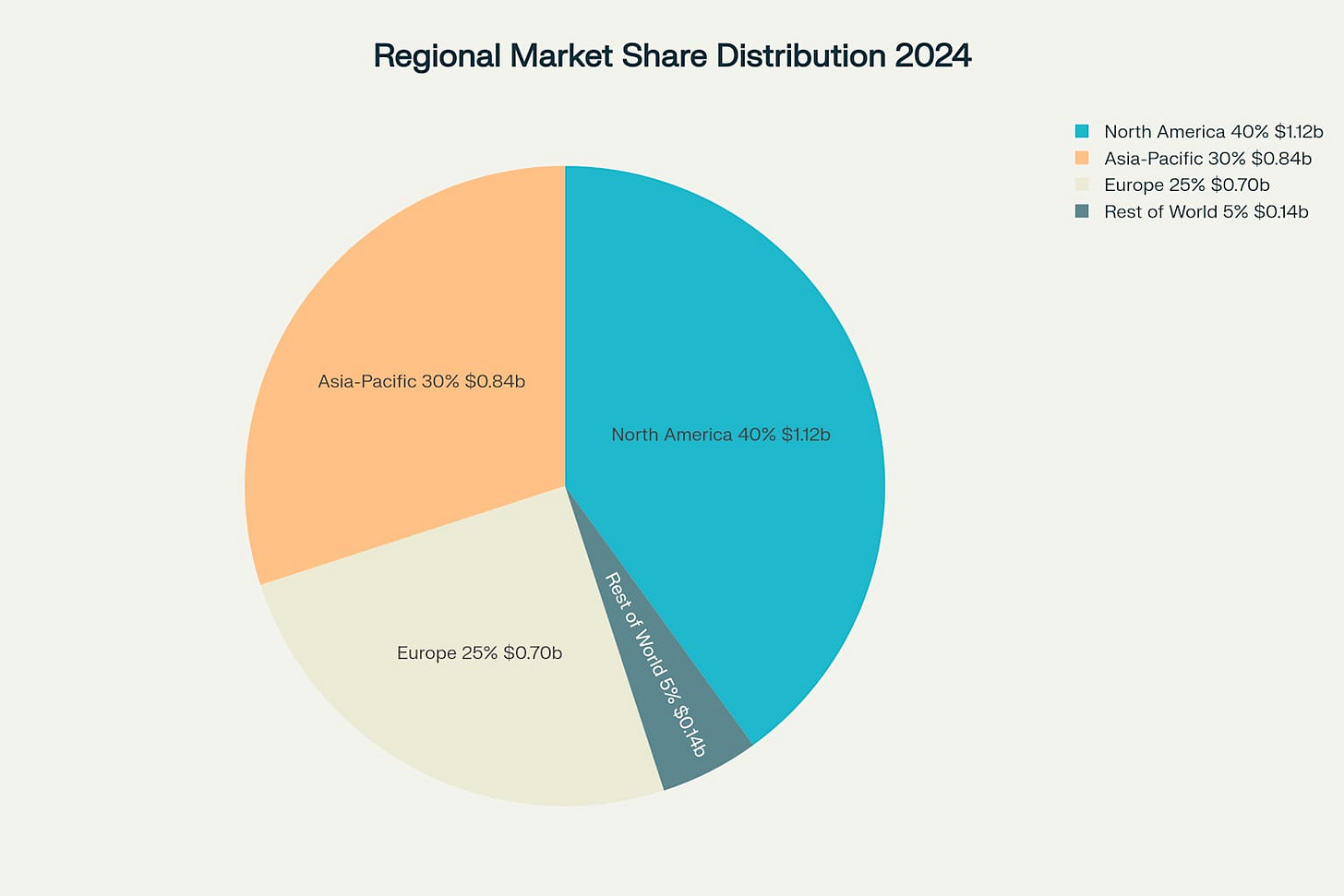

Regional Powerhouses: Where the Money Flows

The global market demonstrates clear regional concentration, reflecting both manufacturing capabilities and regulatory advantages. North America dominates with a 40% market share, representing USD 1.12 billion in 2024, driven by advanced healthcare infrastructure and the presence of leading biopharmaceutical companies.

Asia-Pacific follows with 30% market share at USD 0.84 billion, growing at the fastest rate of 12.5% CAGR due to increasing pharmaceutical production and government healthcare investments. Europe maintains 25% of the market at USD 0.70 billion, supported by robust biotechnology expansion and advanced manufacturing capabilities in countries like Germany and the UK.

Market Leaders: The Titans of Fill-Finish

Lonza Group: The Swiss Precision Leader

Lonza Group maintains undisputed market leadership with CHF 6.6 billion in 2024 revenues1, establishing its position through Swiss-quality manufacturing standards and comprehensive technological capabilities. The company's Integrated Biologics platform accounts for 50% of group revenues, providing clear competitive differentiation through end-to-end biologics solutions.

Lonza projects nearly 20% sales growth in its CDMO business for 2025, with core EBITDA margins approaching 30%. The company's reputation for premium quality positioning allows it to command higher pricing while maintaining strong customer loyalty in an increasingly capacity-constrained market.

Samsung Biologics: The Rising Eastern Giant

Samsung Biologics emerges as a rapidly ascending competitor, benefiting significantly from geopolitical dynamics and aggressive pricing strategies. The company has achieved remarkable growth, with 57.7% year-over-year sales growth3, the highest among global CDMO leaders. Samsung operates 784 kL total capacity by 2025 and has received consecutive CDMO Leadership Awards.

The company's no-upfront-fee model and fast manufacturing processes have attracted customers seeking alternatives to traditional Western CDMOs. Quality systems are expected to achieve number two positioning in the near term, challenging established players through operational excellence and competitive pricing.

The Catalent Disruption

Catalent's USD 16.5 billion acquisition by Novo Holdings represents one of the most significant market disruptions in recent years1. This transaction creates substantial uncertainty as capacity traditionally serving diverse customers may be redirected toward Novo's internal GLP-1 manufacturing requirements. The acquisition demonstrates the strategic value placed on manufacturing capacity in an increasingly constrained market.

Regional Champions and Specialists

ROVI demonstrates the most aggressive capacity expansion strategy, increasing from 215 million pre-filled syringes in 2022 to 725 million expected by 20261 – more than tripling capacity within four years. This expansion positions ROVI as a major European fill-finish provider capable of meeting growing demand.

Jubilant Pharmova achieved 14% year-over-year revenue growth reaching Rs. 1,272 crore in FY25, with EBITDA margins expanding 570 basis points to 23%1. The company is investing USD 100 million in Montreal facility expansion for liquid and lyophilization operations, demonstrating commitment to North American market expansion.

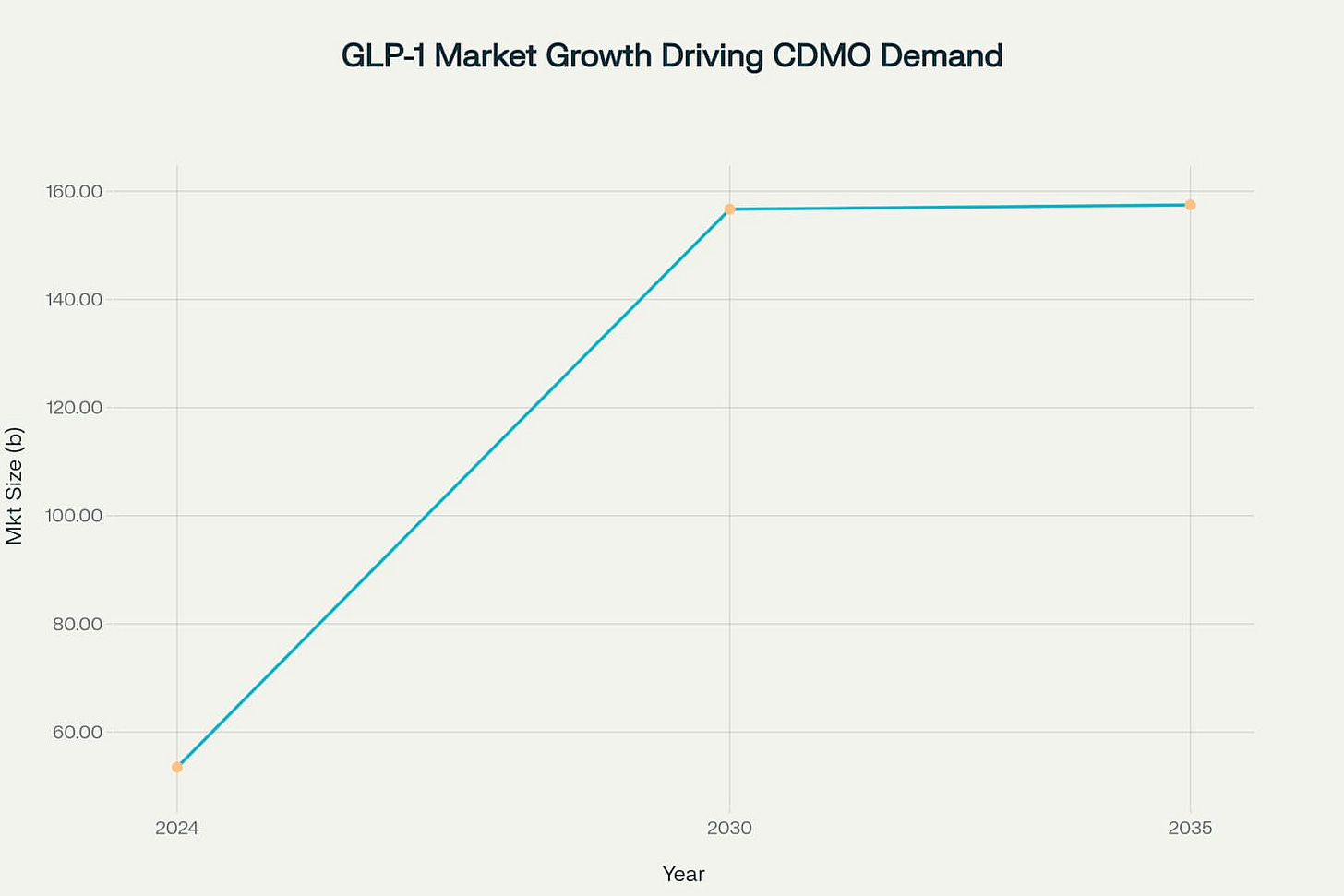

The GLP-1 Revolution: Reshaping Demand Dynamics

GLP-1 therapeutics represent the most significant demand driver currently transforming the fill-finish landscape. The global GLP-1 receptor agonist market was estimated at USD 53.46 billion in 2024 and is projected to reach USD 156.71 billion by 2030, growing at a remarkable CAGR of 17.46%.

The explosive growth in diabetes and weight management treatments has created unprecedented capacity constraints across the industry. Industry experts note that "the indirect effect of the demand spike for GLP-1s is the displacement of capacity for non-GLP-1 sterile injectable drug product manufacturing". This displacement effect is forcing pharmaceutical companies to diversify their CDMO partnerships and seek alternative capacity sources.

Novo's acquisition of Catalent exemplifies this trend, as traditional third-party capacity may be redirected toward internal GLP-1 manufacturing requirements, intensifying competition among remaining independent CDMOs for displaced capacity demand.

Critical Capacity Crisis: The Industry's Defining Challenge

The aseptic fill and finish industry faces an unprecedented capacity crisis that threatens to limit growth potential despite soaring demand. Leading CDMOs are fully booked until 2029, with manufacturing lead times extending 12-24 months for sterile manufacturing slots1.

This supply-demand imbalance creates significant pricing power for established players while forcing pharmaceutical companies to plan manufacturing capacity years in advance. The industry exhibits high barriers to entry through substantial capital requirements, with 4-6 year lead times for new capacity development and complex regulatory compliance needs1.

Investment activity has reached record levels as companies scramble to address capacity constraints:

ROVI tripling capacity to 725 million pre-filled syringes by 20261

Jubilant Pharmova's USD 100 million Montreal facility expansion1

Multiple USD 200+ million expansion projects across major players1

Geopolitical Reshuffling: The BIOSECURE Act Impact

The BIOSECURE Act represents the most significant geopolitical development affecting the aseptic fill and finish industry. The legislation specifically targets large Chinese CDMOs including WuXi Biologics and WuXi AppTec, fundamentally reshaping competitive dynamics.

Key impacts include:

79% of biopharmaceutical companies currently have contracts with Chinese CDMOs5

WuXi AppTec alone is estimated to be involved in the production of a quarter of drugs used in the United States6

26% of life science companies are actively looking to shift away from Chinese partners5

Supply chain experts note that "the BIOSECURE Act has already triggered more than a couple of years back a rethinking in how we do our supply chain and reduce dependency on China". This legislation is accelerating supply chain regionalization, with companies establishing duplicate manufacturing capabilities across different regions.

Trending Molecules: Beyond GLP-1s

Antibody-Drug Conjugates (ADCs)

ADCs emerge as another high-growth segment, requiring specialized handling capabilities due to their toxic payloads. Market participants emphasize that "there's not many people who do it well", creating competitive advantages for CDMOs with proven ADC fill-finish capabilities.

mRNA Therapeutics

mRNA therapeutics, while representing smaller volumes compared to traditional biologics, are establishing new technical requirements and manufacturing standards following COVID-19 vaccine success. These products require stringent aseptic conditions and specialized handling throughout the manufacturing process.

Biologics and Biosimilars

Biologics continue driving overall market expansion, with the pipeline dominated by complex therapeutic proteins and monoclonal antibodies requiring sophisticated aseptic processing. The market benefits from loss of exclusivities creating biosimilar demand.

Technology Revolution: AI and Automation Transform Manufacturing

The industry is experiencing significant technological advancement that promises to address capacity constraints and improve quality outcomes:

AI and machine learning algorithms are being integrated to improve production operations and predict potential manufacturing issues7

Automation and robotics adoption is expected to fuel further investment in manufacturing capabilities.

Continuous manufacturing and advanced process controls are gaining traction among leading CDMOs.

Single-use technologies are improving efficiency and reducing contamination risks.

3D vision cameras help visualize the filling process without entering manufacturing units, while AI-enabled robotics automate GMP filling processes, providing standardized manufacturing and operational flexibility.

Market Forecast: Sustained Growth Through 2035

Market forecasts indicate continued robust expansion across aseptic processing segments. The global aseptic connectors and welders market, a critical component of fill-finish operations, is projected to reach USD 5.39 billion by 2033, growing at a CAGR of 14.96%. The U.S. market specifically is expected to achieve USD 2.35 billion by 2033 with a CAGR of 14.8%.

These growth rates significantly exceed traditional pharmaceutical manufacturing sectors, underscoring the strategic importance of aseptic capabilities in modern drug development and commercialization.

Strategic Implications: Navigating the New Landscape

The aseptic fill and finish CDMO market presents both exceptional opportunities and significant challenges for industry participants:

For Pharmaceutical Companies:

Early capacity planning is essential, with contracts requiring initiation 12-24 months in advance

Geographic diversification of manufacturing partnerships reduces geopolitical risks

Quality differentiation becomes increasingly important as capacity constraints persist

For CDMOs:

Capacity expansion investments offer significant returns in a supply-constrained market

Technological advancement in automation and AI provides competitive differentiation

Geographic positioning aligned with regulatory preferences creates strategic advantages

For Investors:

The industry demonstrates sustained growth potential driven by structural demand shifts

High barriers to entry protect incumbent players from new competition

Pricing power from capacity constraints supports strong financial performance

Conclusion: A Market in Transformation

The aseptic fill and finish CDMO market stands at the intersection of multiple powerful trends reshaping the pharmaceutical industry. The combination of biologics revolution, capacity constraints, geopolitical realignment, and technological advancement creates a unique investment opportunity with sustained growth potential.

Success in this evolving landscape requires navigating complex regulatory requirements, substantial capital investments, and changing technological demands while maintaining the highest quality standards essential for patient safety. Companies that can effectively balance these requirements while building scalable, geographically diversified operations will be best positioned to capture the significant opportunities ahead.

The market's transformation from a niche manufacturing service to a strategic cornerstone of pharmaceutical development reflects the broader evolution of the industry toward more complex, specialized therapies requiring sophisticated manufacturing capabilities. As this trend continues, the aseptic fill and finish CDMO market will remain a critical enabler of pharmaceutical innovation and patient access to life-saving treatments.